The information below is presented in accordance with EU Regulation 2019/2088, Sustainable Finance Disclosure Regulation (SFDR).

Nordic Equities Global Stars Sustainability-related Disclosures

Summary

General

The Fund promotes environmental characteristics such as the reduction of greenhouse gas emissions, the reduction of carbon dioxide emissions, and the increased use of renewable energy. The Fund promotes environmental or social characteristics without having sustainable investment as its objective.

The Fund’s investment strategy and the sustainability criteria included in it are described below:

ESG Screening

The Company has acquired the ESG screening tool Global Standards Screening through Morningstar / Sustainalytics. This norm-based tool evaluates the extent to which potential portfolio companies cause, contribute to, or are associated with violations of international norms and standards.

ESG Analysis

Before each investment, the Fund Company conducts an analysis of the portfolio company based on specific sustainability aspects. The Fund Company reviews the sustainability reporting published by the portfolio company, carbon dioxide emissions, the potential involvement of the portfolio company’s products in sectors excluded by the Fund Company (see below for exclusion criteria), and the portfolio company’s potential contribution to one or more of the UN’s 17 global sustainability goals.

Exclusion Criteria

The Fund Company has established certain exclusion criteria that the fund applies. The Fund Company has excluded investments in industries and sectors where it sees no long-term sustainability or societal benefit. The fund excludes companies involved in coal power, fossil fuels, tobacco, commercial gambling, pornography, weapons, cannabis, or animal testing.

Inclusion Criteria

The Fund Company has established a framework for the criteria set by the Fund Company for a portfolio company to be classified as a so-called promoting company. These companies are actively included in the fund as they contribute to achieving the environmental characteristics the fund aims to promote. The Fund Company’s framework for promoting companies is outlined in section 4 “Investment Strategy.”

Sustainability Criteria During Investment

During the investment in the portfolio company, the Fund Company receives information through Morningstar / Sustainalytics with ongoing alerts regarding ESG-related incidents in the portfolio companies.

The Fund Company has decided that investments placed on the Morningstar / Sustainalytics Watchlist should be further reviewed and considered for retention within six months if the portfolio company has not changed its outlook to positive within the period or if new information has emerged from contact with the portfolio company. Portfolio companies that have become non-compliant should be further reviewed and considered for divestment within three months if no actions have been taken or new information has emerged.

Monitoring

The Fund Company monitors the promoting characteristics that the fund aims to promote through the Fund Company’s investment council and the meetings held within the council. Furthermore, compliance with the sustainability information provided for the fund will be checked by the Fund Company’s control functions in the second and third lines of defense; the risk management function, the compliance function, and the internal audit function.

Method and Due Diligence

The Fund Company measures the promotion of the environmental characteristics that the fund promotes at the fund level by collecting data on certain sustainability indicators, including greenhouse gas emissions and carbon footprint. Furthermore, the Fund Company measures the achievement of promoting characteristics at the individual level regarding the fund’s promoting companies by reviewing the sustainability reporting and specifically the climate-related key figures provided by the portfolio companies.

Data

The Fund purchases data from the external third-party provider Morningstar / Sustainalytics, which is then included in the Fund Company’s ESG analysis before investment and during the investment period to measure the achievement of promoting characteristics and to perform ongoing monitoring of portfolio companies.

The Fund Company assesses that there are certain limitations regarding the sustainability data collected due to the lack of available sustainability data. The Fund Company has taken best effort measures to obtain reliable and qualitative sustainability data by using a trusted third-party provider for sustainability data. In cases where Morningstar / Sustainalytics has been unable to provide the data, the Fund Company has directly approached the portfolio companies to request it.

Shareholder Engagement Strategies

Due to the size of the Fund Company, it has been decided that the Fund Company will not engage in advocacy work in portfolio companies by voting at general meetings. Instead, the Fund Company conducts advocacy work by annually sending letters to portfolio companies, expressing its stance on any sustainability-related issues and questioning any incidents that have been identified through the screening tool used by the Fund Company.

Read more:

No Objectives for Sustainable Investment

This financial product promotes environmental or social characteristics but does not have sustainable investment as its goal

2023-01-01

The Environmental or Social Characteristics of the Financial Product

The fund promotes the environmental characteristics of reducing greenhouse gas emissions, reducing carbon emissions, and increasing the use of renewable energy

2023-01-01

Investment Strategy

Nordic Equities Global Stars is an equity fund focused on the Nordic market. The fund’s strategy is to invest in financial instruments deemed most valuable by the fund company, based on an assessment of market valuation and growth potential. The company evaluates each stock individually, known as stock picking, which means the fund is not dependent on sector weighting. The fund company has established a sustainability policy, which is part of the company’s management policy, and includes sustainability criteria for management.

Within the framework of the fund’s investment process, sustainability criteria are applied through three methods: exclusion, inclusion, and influence. Below is a description of how the sustainability criteria are continuously implemented in the investment strategy.

Before Investment

ESG Screening

The Company has acquired the ESG screening tool Global Standards Screening through Morningstar / Sustainalytics. This norm-based tool evaluates the extent to which potential portfolio companies cause, contribute to, or are associated with violations of international norms and standards. The evaluations cover screening against the UN Global Compact, International Labour Organization (ILO) conventions, OECD Guidelines for Multinational Enterprises, and the UN Guiding Principles on Business and Human Rights (UNGP). The negative screening means that a potential portfolio company is first screened by Morningstar / Sustainalytics to identify any sustainability risks associated with the portfolio company. For the fund to invest in the portfolio company, the portfolio company must be compliant with the screening tool.

ESG Analysis

The company conducts an analysis of the company based on specific sustainability aspects before each investment. This sustainability analysis includes, among other things, the ESG screening described above. The fund company reviews the sustainability reporting published by the portfolio company, carbon emissions, the potential involvement of the portfolio company’s products in sectors excluded by the fund company (see below regarding exclusion criteria), and the portfolio company’s potential contribution to one or more of the UN’s 17 global sustainability goals.

Exclusion Criteria

The fund is actively managed, and the exclusion criteria applied therefore have a self-cleansing effect. The fund company acts in its daily work in such a way that trust in the fund company’s operations is maintained and that the operations are sound. The fund strives to conduct its business in an ethical manner characterized by good business practices, morality, consistent actions, and ethics. Against this background, the fund has established criteria for the exclusion of certain sectors and industries that the fund company does not see any long-term sustainability or societal benefit in. These exclusion criteria are described in the question below.

Inclusion Criteria

Several of the fund’s portfolio companies have committed to climate-related goals in accordance with Agenda 2030 or the Paris Agreement’s global warming targets, with the aim of reducing the company’s carbon emissions or other greenhouse gas emissions and increasing the use of renewable energy sources. The fund actively chooses to invest in such companies (“promoting companies”) as they contribute to achieving the environmental characteristics the fund intends to promote. The fund company has established a framework for the criteria that a portfolio company needs to meet to be classified as a promoting company. For the fund company to classify a portfolio company as a so-called promoting company, the portfolio company must meet the following criteria:

- The portfolio company has committed to climate-related goals in accordance with Agenda 2030 or the Paris Agreement, which means that the portfolio company will work to reduce its carbon emissions or greenhouse gas emissions, or alternatively increase the use of renewable energy sources within its operations.

- In addition to point 1, it is required that:

- The portfolio company’s climate-related goals have been validated through the Science Based Targets Initiative, or

- The portfolio company has committed to climate-related goals for several years, and the interim targets have been achieved so far, or

- The portfolio company is a solution company, which means that the portfolio company provides a product or service that contributes to solving the world’s climate and sustainability challenges.

- The portfolio company must also comply with the fund company’s policy for good governance practices.

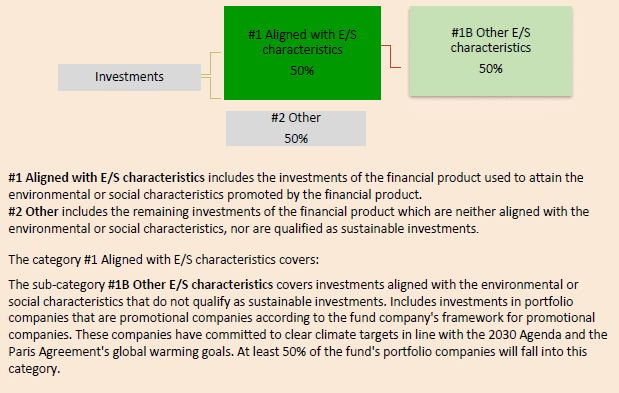

The fund does not exclusively invest in promoting companies; however, any climate-related goals that portfolio companies have committed to are included in the fund company’s ESG analysis, which is why promoting companies are actively selected. The fund will always have a minimum share of 50% in so-called promoting companies. See further under the heading “Share of Investments”.

During Investment

Continuous Monitoring

The fund continuously receives alerts from Morningstar / Sustainalytics regarding ESG events in the fund’s portfolio companies. By receiving continuous alerts, the fund can monitor any events that could lead to the materialization of sustainability risks in the portfolio companies. Furthermore, the fund company maintains close and regular contact with the portfolio companies, allowing the fund company to continuously monitor any events in the portfolio companies that could have consequences for the fund’s sustainability strategy.

Engagement Activities

Due to the size of the Fund Company, it has been decided that the Fund Company will not engage in advocacy work in portfolio companies by voting at general meetings. Instead, the Fund Company conducts advocacy work by annually sending letters to portfolio companies, expressing its stance on any sustainability-related issues and questioning any incidents that have been identified through the screening tool used by the Fund Company. As described above, the fund company maintains close and ongoing contact with the fund’s portfolio companies, which means that the fund company continuously engages in dialogue with the portfolio companies regarding the fund company’s views on sustainability issues.

Divestment

The company has decided that investments placed on the Morningstar / Sustainalytics Watchlist should be further reviewed and considered whether to be retained within six months if the company has not changed its outlook to positive within the period or if new information has emerged during confrontation with the company. Companies that have become non-compliant should be sold within three months unless measures have been taken or new information has emerged.

The Fund Company’s Policy for Assessing Good Governance Practices in Investment Objects.

The Fund Company has adopted a policy for assessing good governance practices in the fund’s portfolio companies, which is part of the fund company’s sustainability policy. The fund company’s policy for assessing good governance practices includes an obligation for the fund company to review that the portfolio company has a sound management structure and a healthy relationship with its employees. Furthermore, the fund company reviews compensation structures for relevant personnel and compliance with tax regulations.

Before investing in a new investment object, the fund company reviews the management structure of the investment object, including the portfolio company’s code of conduct and whether the portfolio company follows the OECD guidelines for multinational enterprises and the UN guiding principles on business and human rights. Furthermore, the fund company monitors the portfolio company’s compliance with good governance practices through ongoing alerts received regarding ESG events related to the portfolio companies from Morningstar / Sustainalytics (as described above). In the event of an incident in one of the fund’s portfolio companies, the fund company engages in dialogue with the portfolio company, and the portfolio company is given the opportunity to comment on the incident.

2023-01-01

Share of Investments

2023-01-01

Monitoring of Environmental or Social Characteristics

The fund company has both internal and external control mechanisms to continuously monitor the promotional characteristics the fund aims to achieve. The fund’s promotional characteristics are internally monitored through the fund company’s investment council, where the sustainability criteria that form part of the fund’s investment strategy are discussed within the framework of the investment council’s meetings.

Furthermore, the fund company also has external control mechanisms through second and third line of defense control mechanisms, which include the risk management function, the compliance function, and the internal audit function that will review and monitor the fund company’s compliance with the sustainability information provided for the fund.

2023-01-01

Methods

The fund company measures the achievement of its promotional characteristics at the fund level by collecting data from Morningstar / Sustainalytics regarding the fund’s performance based on the established sustainability indicators: greenhouse gas emissions (scope 1, 2, and 3 emissions), the investment object’s greenhouse gas emissions, the share of non-renewable energy consumption and energy production, energy consumption intensity per sector with significant climate impact, emissions of inorganic pollutants, emissions of air pollutants, and the breakdown of energy consumption by type of non-renewable energy sources.

For the fund’s promotional companies, the fund company also measures the achievement of promotional characteristics individually for each portfolio company by reviewing and monitoring the portfolio company’s sustainability reporting based on certain climate-related key figures.

2023-01-01

Data Sources and Processing

The fund collects data from Morningstar / Sustainalytics before an investment, as the fund’s holdings are screened through Morningstar / Sustainalytics’ negative screening tool. The fund also considers principal adverse impacts on sustainability factors, and for this purpose, the fund company collects data from Morningstar / Sustainalytics regarding the established sustainability factors. Furthermore, ongoing screening is conducted regarding any ESG-related incidents that have occurred in the fund’s holdings. The fund company also collects sustainability data directly from the portfolio companies, including the portfolio companies’ own sustainability reporting. Additionally, the fund company asks certain ESG-related questions to the portfolio companies before investment and during the ongoing engagement dialogue.

The fund company actively works to ensure the quality of the sustainability data it uses to make well-informed investment decisions based on the ESG analysis conducted before investment. Morningstar / Sustainalytics is a leading ESG research, rating, and data company with 30 years of experience in developing solutions to meet the growing needs for sustainability information.

The fund company does not use any estimated data.

2023-01-01

Limitations of Methods and Data

The fund company assesses that there are certain limitations regarding the sustainability data collected due to the lack of available sustainability data. The implementation of the Corporate Sustainability Reporting Directive and reporting standards from the European Financial Reporting Advisory Group is necessary to provide information on reliable quantitative indicators.

The fund company has taken best effort measures by using a trusted third-party provider for sustainability data, and in cases where Morningstar / Sustainalytics cannot provide the data, the fund company directly approaches the portfolio companies to request the data.

2023-01-01

Due diligence

The fund company conducts due diligence of the portfolio companies in the fund by reviewing the portfolio company’s sustainability reporting of the climate-related key figures relevant to the fund’s promotional characteristics. Furthermore, as described above, ongoing screening of the portfolio companies is also conducted through Morningstar / Sustainalytics. The fund company receives alerts regarding ESG-related events in the portfolio companies, which then form the basis for the engagement dialogue the fund company conducts with the portfolio company in accordance with the fund company’s principles for shareholder engagement.

2023-01-01

Policy for Shareholder Engagement

As described above, due to its size, the fund company has decided not to engage in advocacy work within the portfolio companies by voting at general meetings. Instead, the fund company conducts advocacy work by annually sending letters to the portfolio companies, where the fund company expresses its stance on any sustainability-related issues and also questions any incidents that have been discovered through the screening tool used by the fund company. As described above, the fund company maintains close and ongoing contact with the fund’s portfolio companies, which means that the fund company continuously engages in dialogue with the portfolio companies regarding the fund company’s views on sustainability issues.

2023-01-01