Nordic Equities

Asset Management

Nordic Equities was founded in 1993 and operates as an independent manager with a focused, fact-based, long-term, and global investment strategy. NE’s clients primarily consist of foundations, pension funds, banks, insurance companies, and family offices. We have both a historical and global perspective and a clear investment model for our five equity funds.

Our highlights

NE Academy

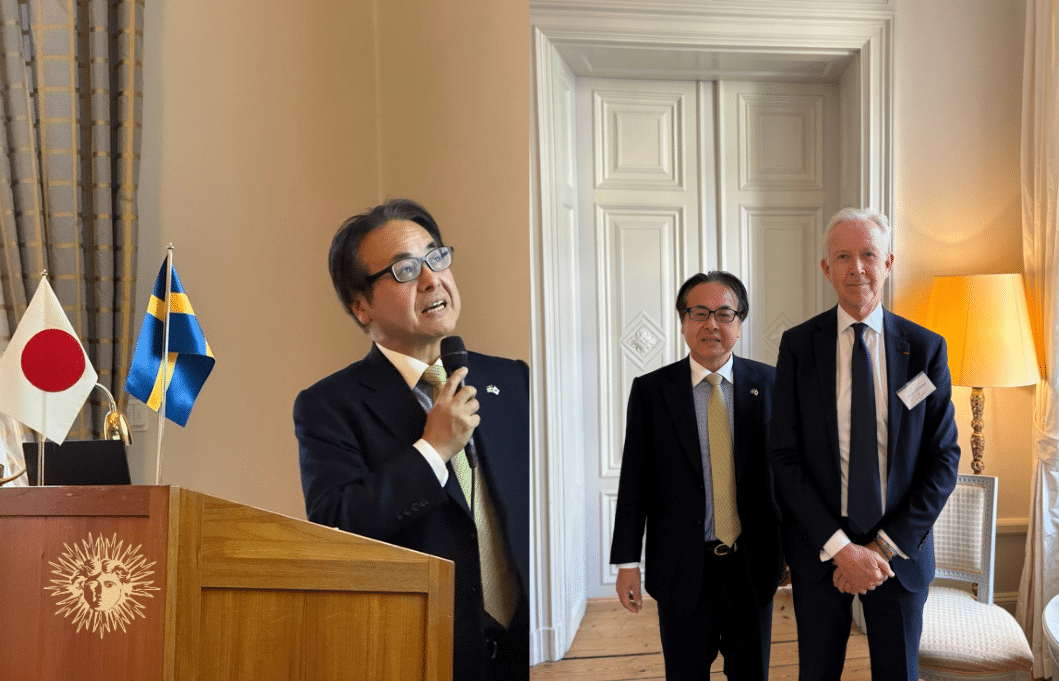

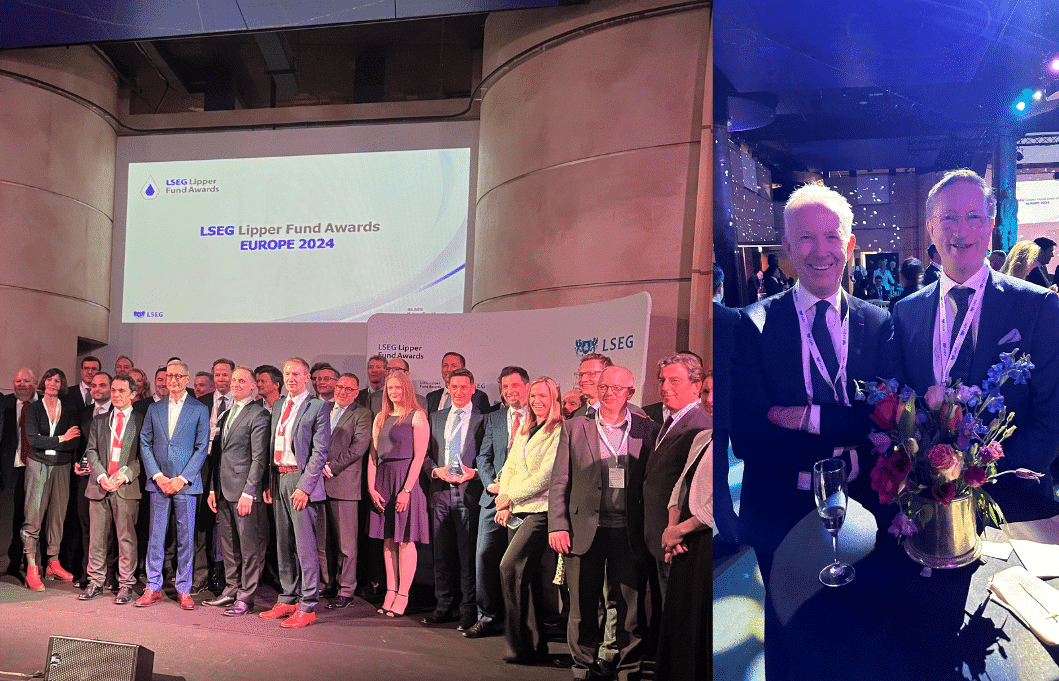

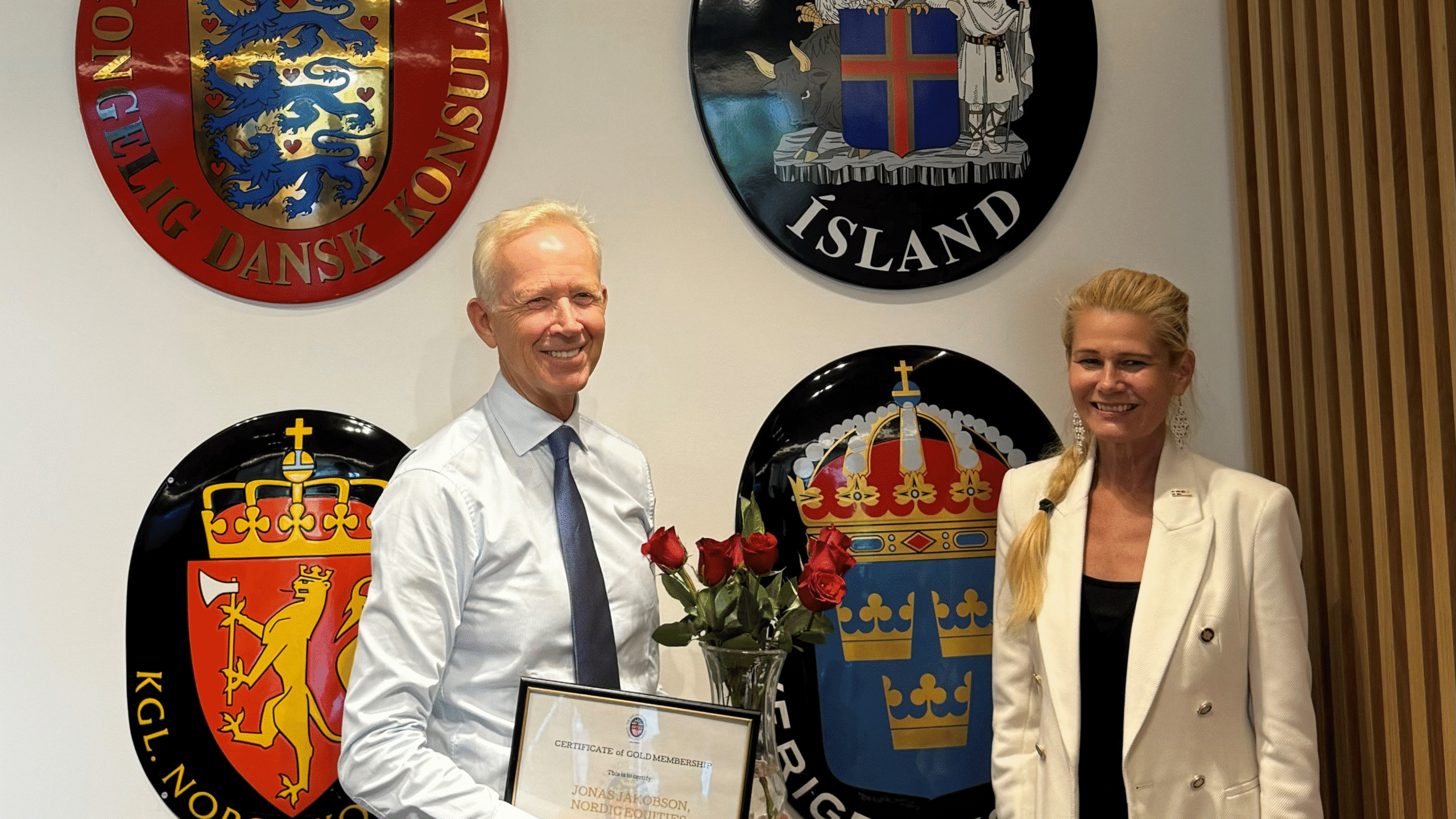

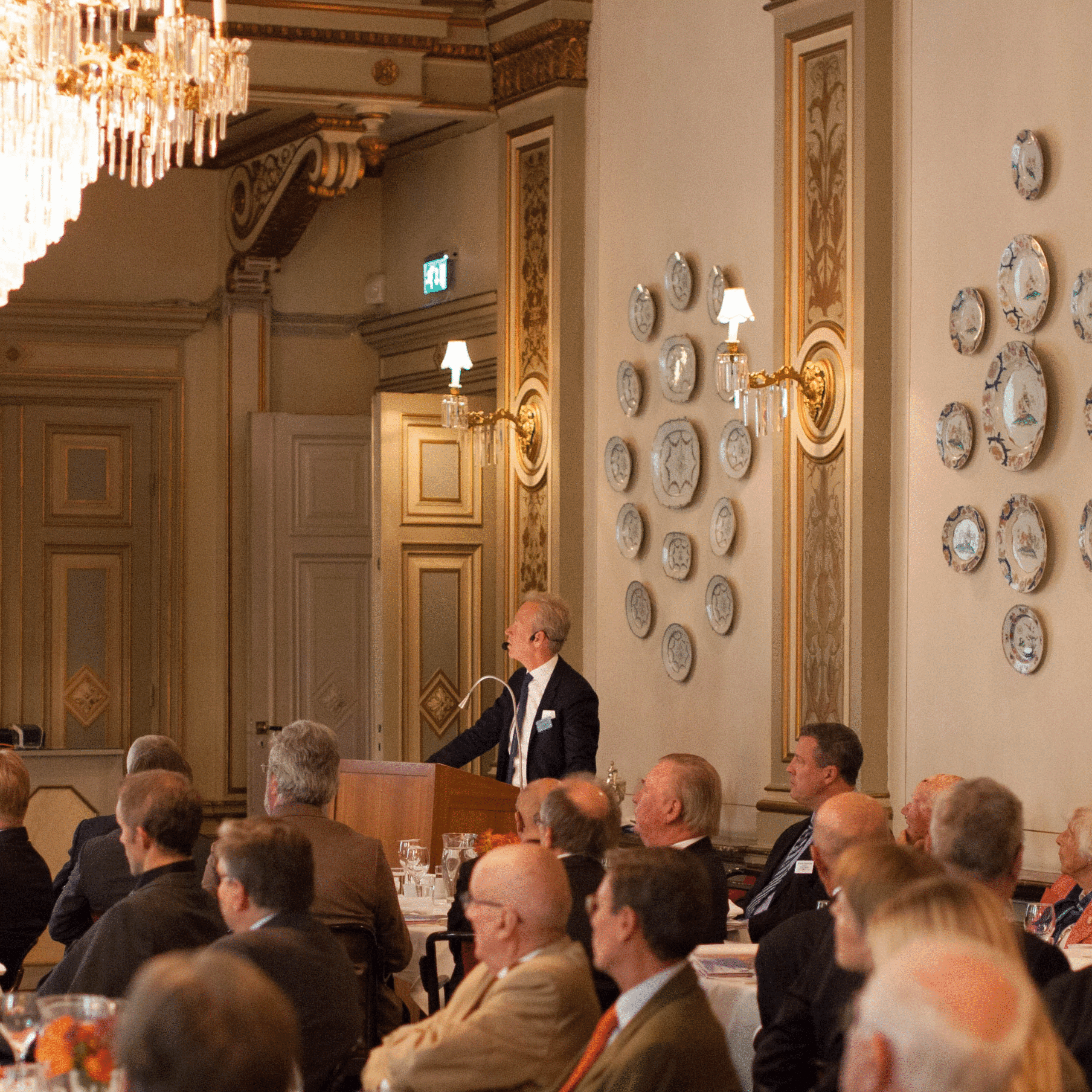

Nordic Equities places great emphasis on bringing together

experts such as CEOs of global companies,

investors, diplomats and ministers to discuss

how future themes such as GURAIS (Globalization,

Urbanization, Robotization, Artificial Intelligence,

Digitization and Standardization) affect the world

and investments.

Our Strategy

Nordic Equities’ global investment model “Outside view” has both a horizontal global perspective and a vertical; historical and forward-looking perspective based on our investment themes GURAIS (Globalization, Urbanization, Robotization, Artificial Intelligence/digitalization, and Standardization).

We base our investments on over 4000 companies and place great emphasis on the companies’ historical and potential future growth. We have focused portfolios and invest for the long term.

Our funds

NE Our World

Equity fund with global companies that contribute to a better world.

Do you want to become our client?

Nordic Equities was founded in 1993 and is an independent manager with a focused, fact-based, long-term, and global investment strategy. NE’s clients primarily consist of foundations, pension funds, banks, insurance companies, and family offices. We have both a historical and global perspective and a clear investment model for our five equity funds.